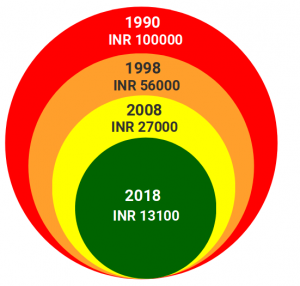

INR 1,00,000 in the Year 1990 is roughly equal to INR 13100, at present. This shows that 7% inflation over 28 years eroded approximately 87% of your wealth.

INVESTMENT TACTICS

With Vibgyor, you can become completely financial independent!

Discover our strategy to help you with financial goals

![Investment tatics - [Infographic] Investment tatics - [Infographic]](https://www.vibgyorfinserv.com/wp-content/uploads/2018/12/Investment-tatics-Infographic-642x768.png)

Goal-based Investment Strategy can Work Wonders for your Future!

Learn how Vibgyor FinServ helps you to become financially liberated!

At Vibgyor, all our efforts are channelized to make our Clients and the Common Public realize the wonders of disciplined investing. Using our expertise and experience, we develop GOAL-BASED financial plans for you that some important principles and full-proof strategies.

Goal-based Financial Plan Full-proof Strategy to Help you Achieve Financial Freedom

At Vibgyor FinServ, we understand that goal-based financial planning is the only way you can achieve financial freedom and achieve your financial goals. Because without any direction, you would end up getting lost. Without a clear picture, you would not be able to accumulate the money you require at a future stage for any specific Financial GOAL

We create a Financial Plan using TIME LINE and Inflation to arrive at a Correct Investment Strategy. Hence, we rely ONLY on financial calculators and spend a considerable amount of time in devising a hand-written financial plan to help our clients invest prudently and achieve goals.

Defining Inflation-adjusted Corpus Requirement The Only Way to Make your Money Actually Grow

Before anything else, it is important to have a clear idea of the amount you would require. INR 1000/- today will not be the same after one year. That is because of the impact of inflation. Everyone hears about inflation but while making an investment, no one considers that the amount you are accumulating for the future should have the ability to beat the inflation rate.

How Inflation Eats up your Money?

Inflation reduces your money over years @ 7%

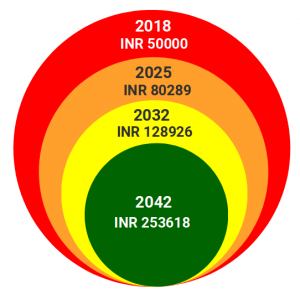

Value of Money over the years @ 7% Inflation

To sustain the same lifestyle in the future, you would need your money to grow at a rate that beats inflation. You would require INR 2,53,618/- in 2042 to buy the same goods that cost INR 50,000/- in the year 2018.

That is why we always identify inflation-adjusted corpus and link your requirement to investment instruments that would easily beat inflation rates over the years, leading to real capital appreciation.

Periodic Portfolio Evaluation & Right Asset Allocation The Key to Keep Going in the Right Directionr

Only setting a goal and start moving in the direction will not promise best results. In a dynamic financial environment, it is important to fine tune your investment and align them to changing goals and growth metrics. Without periodic evaluation and right asset allocation, you will not be stuck in turbulent tides and might even lose your hard-earned capital.

That is why we believe in balancing your portfolio with the right funds and instruments that are in sync with market condition and your personal goals.

Investing is Similar to Traveling Without a Proper Itinerary/Plan, you are up for a Shock!

Just like traveling, investment should never be done impromptu if you really want to make the best out of your time and money. Understanding the scenario, timing your move and having an expert advisor will not only give you the best returns but will also ensure you have a pleasant experience.

To make your investment experience beneficial, we identify your future needs by finding answers to the following questions:

– What are your financial goals?

– How much time you have in hand to achieve your goal?

– How much money (Corpus) is required to achieve the goal

– What is your personal risk profile?Based on the above questions, we identify the most appropriate financial instrument, guide you about when to start investing and in turn become your dependable financial wellness expert, just like a travel guide!

Goal-based Tactics will Lead You to a Path of Fulfilling Returns